We are in a massive student debt crisis. $1.7 trillion of student debt is owed by 44 million people in the United States. This student debt crisis is especially hurting young people already stunted by rising housing prices, low wages, and recessions. And many young people know that the effects of student debt reach far beyond debt holders. Student debt affects our families, our loved ones, and our larger communities. It limits our ability to dream about building the future we deserve. Millions are putting their futures on hold – buying a house, getting married, having children – because they can barely keep up with their monthly student loan payments.

This is why we launched Dreams Not Debt — to build a future where young people are financially free to dream and not be held back by student debt.

Explore this page

How you can take action

Sign the Petition today

A problem as massive as the student debt crisis requires bold solutions. That’s why we are calling on the Biden Administration to:

- Take bolder steps in addressing the student debt crisis by canceling all current student debt

- Reform the student loan program to mitigate future student debt

- Make public colleges and universities free for all students

Share your Student Debt Story

Whether you currently have student debt or are worried about future student debt, we want to hear your story. We want to know what future you are not able to dream up for yourself because of student debt.

Those in power like President Biden must hear the stories of those with student debt and take action on the student debt crisis. We deserve the right to dream freely, not be held back by student debt.

Share the Dreams Not Debt Actions

Let your friends and family know you’ve joined the movement to cancel student debt and they can too.

Share on social media and via email!

Poll Results

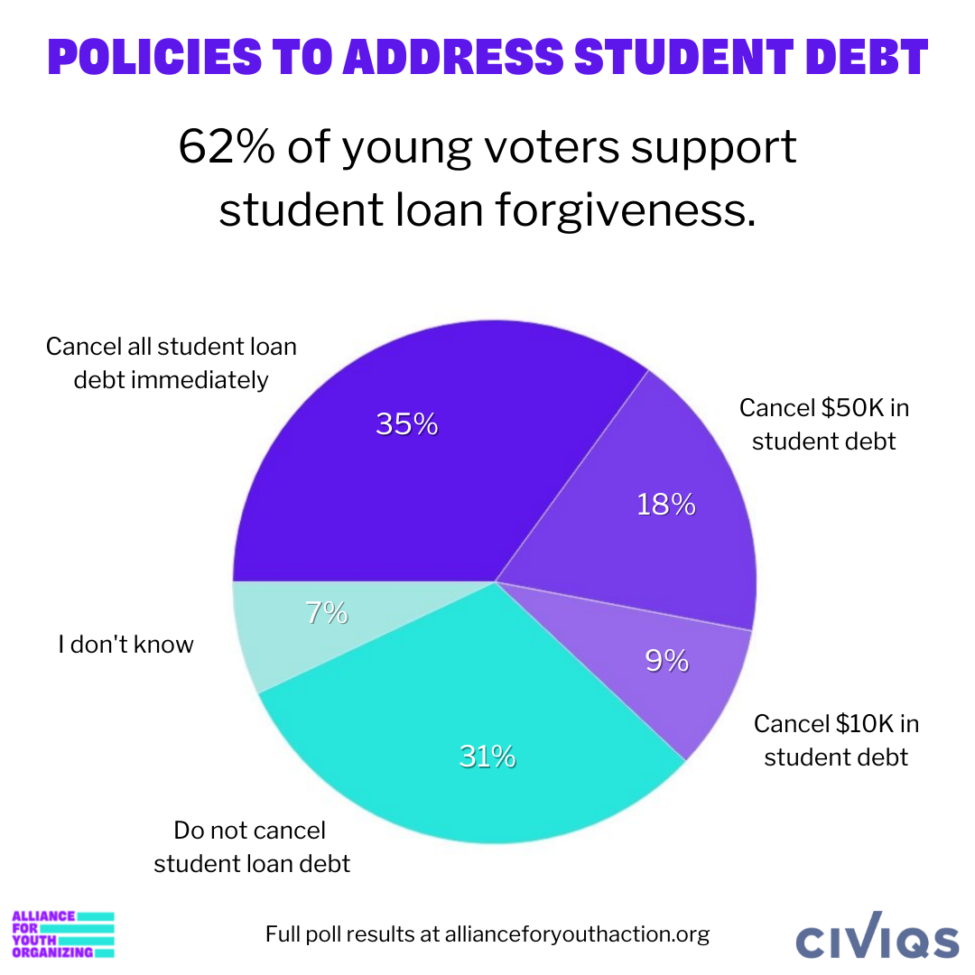

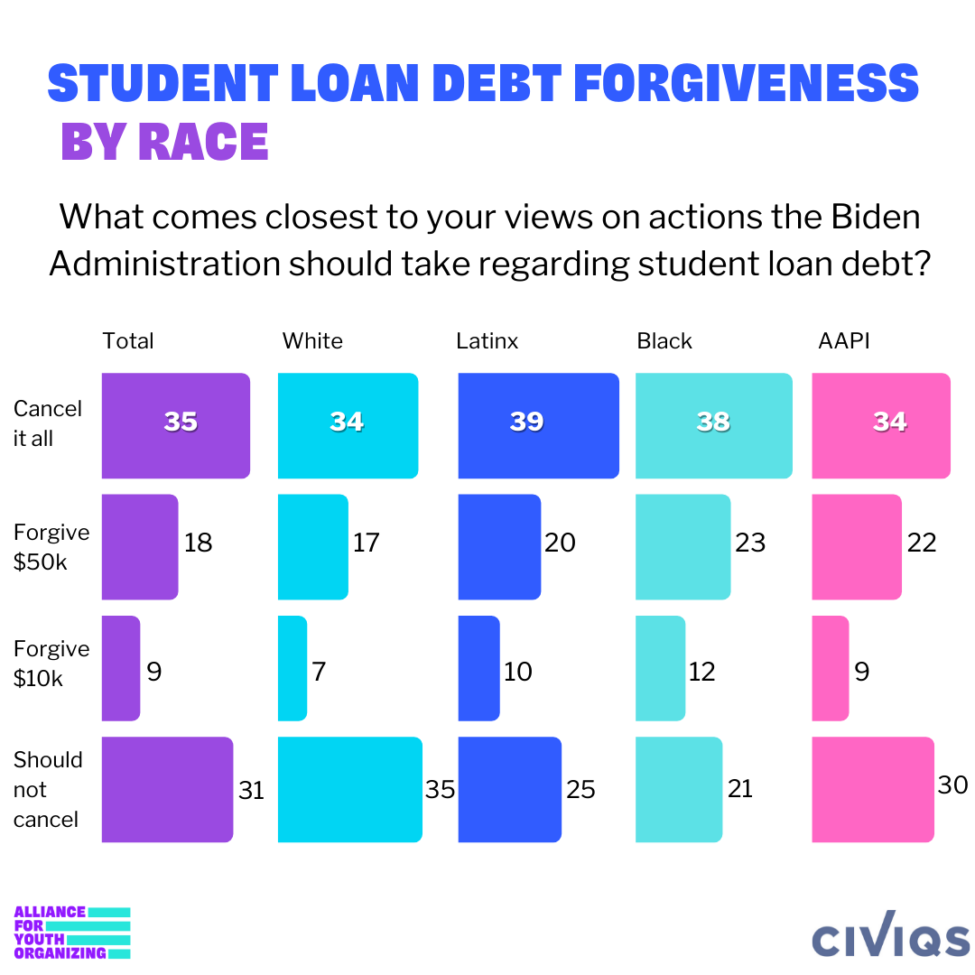

Our sister organization, Alliance for Youth Organizing, in collaboration with Civiqs, surveyed young voters ages 17 – 39 nationwide from across the political spectrum. We asked how they feel about the country’s future, what policies the Biden Administration should prioritize, how they plan to engage this year leading up to the midterm election, and more. Canceling student loan debt was one of the top policy priorities for young people–especially young people of color. With 62% of all young voters wanting some form of student loan forgiveness, student debt will remain a top issue for young voters as they head to the ballot box this fall.

Read student debt stories

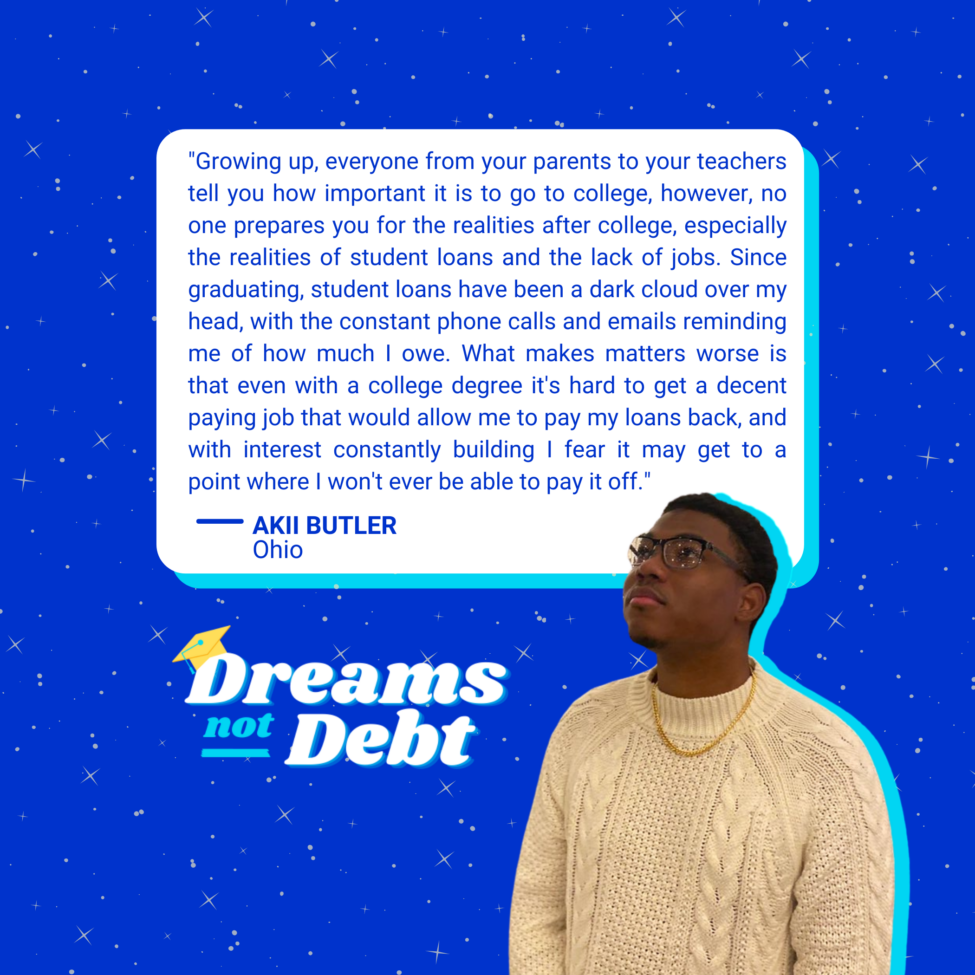

Forty-four million people across the country have student debt. A number this big is difficult to conceptualize and put into context. That’s why we think it is vital to share individual stories from borrowers about what it is like to carry student debt as a young person. Our elected leaders need to understand how student debt affects our daily lives, decisions, families, and futures.

Learn More about our Student Debt Work

How local organizations are tackling student debt

Organizations in the Alliance Network have been tackling the issue of student debt and college affordability for years at the local level. From fighting for ballot measures to ensure state investment in higher education to protecting the rights of student loan borrowers, youth organizers in the Alliance Network fight to protect past, present, and future students. Learn more about their efforts and wins in our latest blog post.

Watch our Instagram Live with Network Leaders fighting student debt

On Wednesday, June 9th, we hosted another Alliance Chat on Instagram Live about student debt. We chatted with leaders in the Alliance Network who are organizing around student debt and college affordability in their community.

Speakers:

– Morgan Royal, New Era Colorado

– Kalia Harris, Virginia Student Power Network

– Kalesha Scott, Ohio Student Association

– Gnora Gumanow, Alliance for Youth Action (Host)

Back to School, Deeper in Debt

Paying for school is one of the largest stressors for students. While the United States has built financial aid systems like FAFSA (Free Application for Federal Student Aid) to lessen the financial burden, these systems fall short. About $1.7 trillion short. Our current financial aid system for higher education is not working because it was not built for our generation.

Follow and Share #DreamsNotDebt on social media

Additional Resources

We are fighting for student debt cancelation AND we know that many young borrowers have questions about dealing with their loans now. Here are some resources from our friends in the higher education space on your rights, pathways for some relief, and updates on the student loan payment pause.

- Accessing Public Service Loan Forgiveness

- File a complaint if you’ve had problems with your servicer

- Student Debt Crisis Student Loan Borrower Resource Center

- Updates on the student loan payment pause

- Check out our student debt myth-busters video series on Instagram for answers to common questions & concerns around student debt cancelation